Some Known Details About Empower Rental Group

Table of ContentsSome Known Facts About Empower Rental Group.10 Simple Techniques For Empower Rental GroupEmpower Rental Group Things To Know Before You Get ThisEmpower Rental Group Things To Know Before You Get ThisWhat Does Empower Rental Group Mean?The Best Strategy To Use For Empower Rental Group

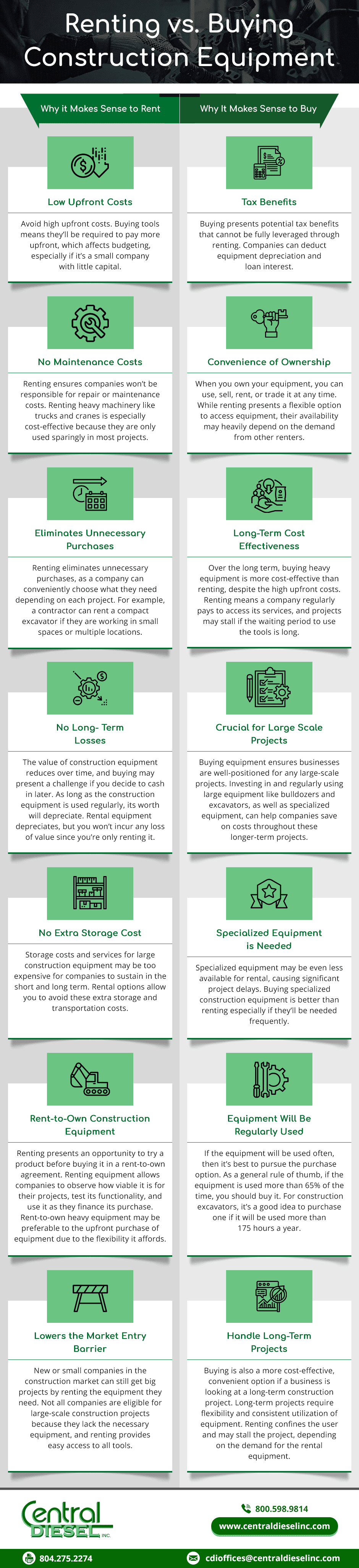

Think about the primary variables that will certainly help you make a decision to buy or lease your construction devices. Your existing financial state The sources and abilities readily available within your company for stock control and fleet management The expenses connected with acquiring and exactly how they contrast to leasing Your need to have devices that's offered at a minute's notification If the possessed or rented devices will certainly be made use of for the proper size of time The biggest determining element behind renting or purchasing is exactly how commonly and in what manner the heavy tools is made use of.

With the various uses for the multitude of building and construction tools items there will likely be a couple of machines where it's not as clear whether renting out is the most effective choice financially or buying will give you better returns in the long run (mini excavator rental). By doing a few easy calculations, you can have a pretty good concept of whether it's finest to lease building and construction devices or if you'll acquire one of the most take advantage of purchasing your devices

An Unbiased View of Empower Rental Group

There are a number of other factors to consider that will certainly enter into play, but if your service utilizes a certain tool most days and for the lasting, after that it's likely simple to determine that a purchase is your finest means to go. While the nature of future jobs might alter you can compute an ideal assumption on your utilization price from recent usage and projected tasks.

We'll discuss a telehandler for this example: Consider the use of the telehandler for the previous 3 months and obtain the number of complete days the telehandler has actually been made use of (if it just finished up obtaining secondhand component of a day, after that add the parts up to make the matching of a full day) for our example we'll say it was utilized 45 days. - boom lift rental

The 30-Second Trick For Empower Rental Group

The usage price is 68% (45 separated by 66 equals 0.6818 increased by 100 to obtain a percent of 68) - https://www.designspiration.com/rentergmoultrie31768/saves/. There's absolutely nothing wrong with projecting usage in the future to have a best rate your future utilization price, specifically if you have some proposal prospects that you have a great chance of obtaining or have actually projected jobs

If your application rate is 60% or over, acquiring is usually the very best choice. If your use rate is between 40% and 60%, then you'll intend to think about exactly how the other elements connect to your company and check out all the advantages and disadvantages of having and leasing. If your application price is listed below 40%, leasing is usually the most effective choice.

10 Simple Techniques For Empower Rental Group

You can trust a resale value for your tools, particularly if your company likes to cycle in brand-new tools with updated innovation. When thinking about the resale value, consider the brand names and versions that hold their value much better than others, such as the dependable line of Pet cat tools, so you can realize the greatest resale worth feasible.

The Buzz on Empower Rental Group

It may be an excellent way to broaden your company, but you also need the recurring company to broaden. You'll have the purchased equipment for the sole use of your organization, yet there is downtime to manage whether it is for maintenance, fixings or the unpreventable end-of-life for a tool.

However, you can't be specific what the marketplace will certainly be like when you aspire to sell. There is called for worry that you won't obtain what you would have expected when you factored in the resale value to your purchase decision 5 or one decade previously. Also if you have a little fleet of devices, it still needs to be correctly procured the most cost savings and maintain the tools well preserved.

Empower Rental Group Things To Know Before You Buy

You can contract out devices administration, which is a feasible alternative for numerous companies that have found buying to be the finest selection however dislike the added work of equipment administration. As you're considering these benefits and drawbacks of buying construction tools, observe how they fit with the means you operate now and just how you see your business five or perhaps one decade later on.